Airlines may be a capital-intensive business, but they’re also a very labor-intensive one. Without the millions of airline staff around the world, not much would happen by way of global travel - despite what current AI excitement may imply.

In recognition of Labor Day in the U.S., we look at how labor costs have changed since 2019.

To nobody’s surprise, they are up. Just like labor costs around the business world are up. What is notable is just how up they are.

For the past 12 months, airline costs per seat mile have increased an average of 22% compared to 2019, compared to an 11% increase in revenue per the same seat mile.

Of course, not all airlines are the same. Southwest currently leads the pack of airlines with the highest people cost, by far, at 6.6 cents per seat-mile over the past four quarters. This is up from a high of 5.3 cents in 2019.

Conversely, Frontier pays its employees 2.3 cents per seat-mile. But before you cast judgment on Frontier’s pay package (positively or negatively), you must also consider the rapid rise in seat gauge, growth in the fleet, and relatively junior staff.

Re-ordering the chart by the number of ASMs deployed shows how much the smaller airlines have increased their labor costs relative to where they stood in 2019. The largest increases were from Spirit, Frontier, and Allegiant. Notice any patterns?

note: Sun Country did not report 2019 numbers. Frontier has reported 2019 numbers in their original IPO filing.

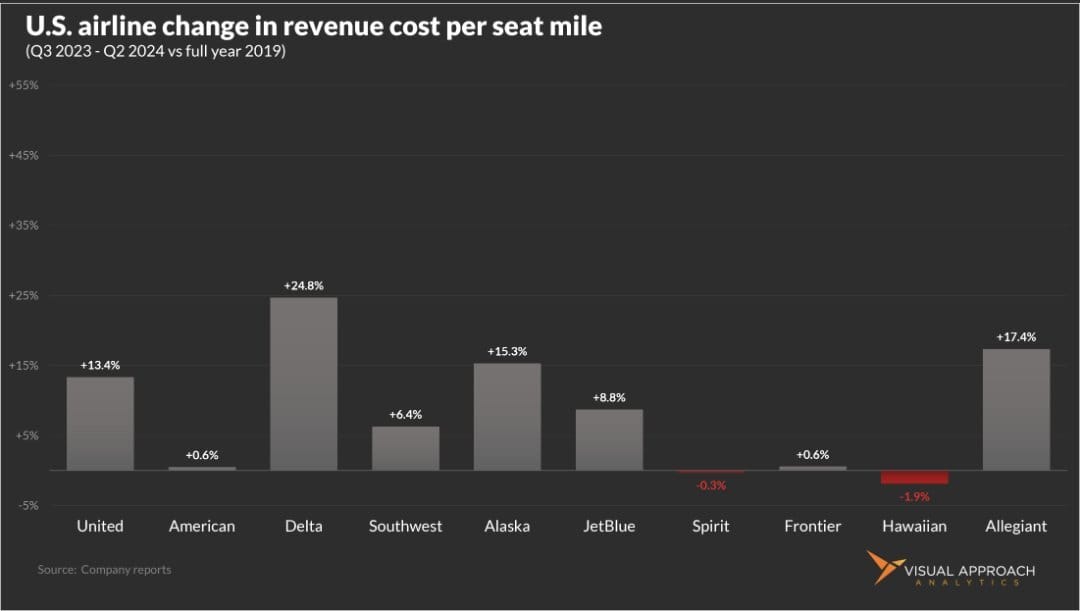

Revenue per seat-mile hasn’t exactly kept up. The average RASM is up 11%, largely due to Delta, United, and Alaska. Spirit and Hawaiian are showing slightly negative RASM growth, while Frontier and American remain largely flat.

Two airlines stand out to us on this RASM chart, 2024 vs 2019 — American and Allegiant.

Despite being in the legacy category, American has not seen the revenue strength of United and Delta. (Considering the Elliott team continues its assault on Southwest, citing poor revenue performance, we are still left wondering if they confused DAL with DFW when initially booking their field trip to “improve” an airline).

Allegiant, on the other hand, shows just how critical the ability to price in monopoly markets can be in a hot labor market. Even so, the airline’s unit revenue has still lagged unit labor costs by a substantial margin.

Just as easily, the opposite conclusion can be made of ULCC colleagues Spirit and Frontier - two low-cost airlines deploying large aircraft into large, highly competitive markets.

But, it is the comparison of the two that draws our attention to the current state of the U.S. airline industry.

Costs up, revenue less so.

The gap in yellow shows how much more labor costs have grown compared to revenues, still adjusted on a capacity basis. Consider, as well, that this comes during a time of rapid seat-gauge expansion. In other words, during a time when more ASMs can be deployed with minimal gains in labor.

So, what’s up with labor?

COVID happened, yes. The U.S. went through a very sharp, self-induced pilot shortage during a time when many pilot contracts were due, yes. But, our attention is paid more to the macro picture.

Just as the days of zero interest rates are likely over, so too are the days of ultra-low inflation. A global market flush with both capital and labor has shifted to one increasingly constrained by both.

Regardless of COVID, this world was shifting out of population growth well before. To oversimplify, population growth = labor supply. With less labor supply, the shift in leverage shifts back to labor. Leverage = money.

We expect the next 20 years to continue this shift around the world. The step away from globalization only furthers the shift.

Sans any major conflicts that would upset the typical economic cycle between capital and labor (an overdue long-term cycle of its own), the shift in leverage will continue to be toward labor.

That means higher yellow bars are likely here to stay.

Our research published this week

You should do a chart on…

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact