Travel has returned to the African continent, but things look slightly different in 2023 than in 2019.

In response to a reader request, we look closer at the African market and the recovery in the region.

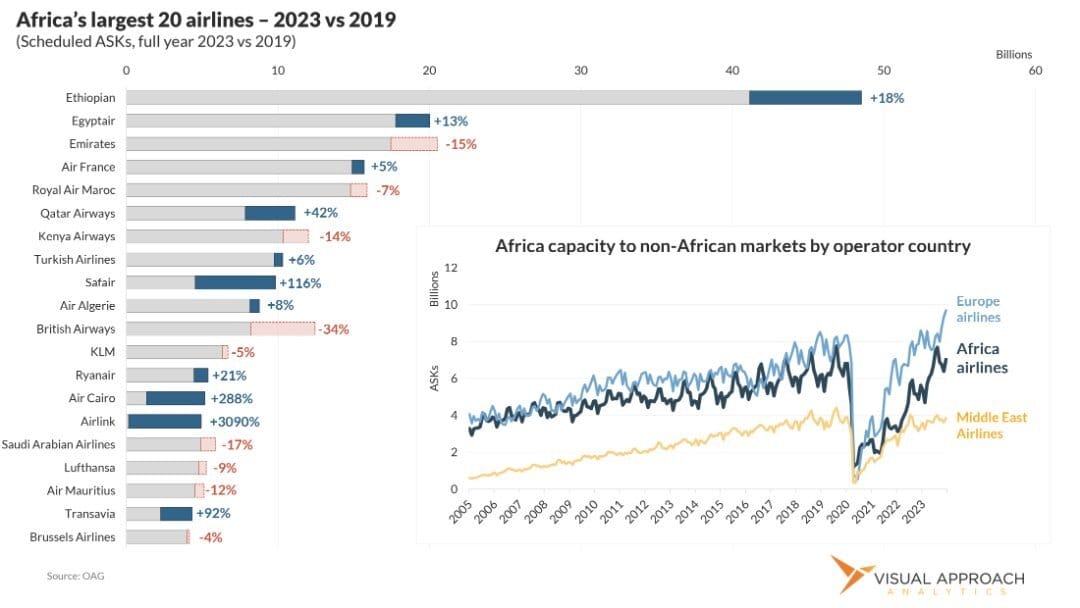

Ethiopian Airlines continues to dominate the market, providing more than twice the number of ASKs touching Africa than the second-highest, Egyptair. With the strong connecting hub in Addis Ababa, Ethiopian has increased its presence by 18% since 2019.

Of course, 2019 also included a year of troubles for the MAX and Ethiopian, in particular. Still, the regrowth of the airline has been impressive, leading the African airlines by an impressive margin.

Notable, as well, is the swap between second and third place between Egyptair and Emirates. Pulling passengers from Africa to its Middle Eastern hub in Dubai, Emirates is operating 15% less capacity than in 2019, while Egyptair has increased by 13%.

Notably absent from this list is South African Airways. Holding fourth place in 2019 by our calculations, South African also announced it would enter bankruptcy protection late that year. While there is never a good time to enter bankruptcy, the mounting challenges reached a critical state right before modern history's worst drop in global travel.

Today, South African Airways is producing 82% fewer ASKs, falling well off the list when looking at the entire continent.

Both African and European capacity has evenly accommodated the return of African air travel. Interestingly countercyclical, the boost in European capacity late in 2023 is a return of seasonal lift that matches prior patterns.

Add in the near-loss of South African Airways from the continent’s bucket of capacity, and the African airlines have done very well in recovering capacity touching other regions. The Middle Eastern carriers have been slow to return to the market, likely representing the slower business travel return and slow Asia reopening.

However, European airlines, particularly leisure in nature connecting to markets in North Africa, have added significant seasonal capacity boosting in late 2023.

Despite South African’s challenges, Africa remains a growth market and one well served by Ethiopian Airlines, Egyptair, Royal Air Maroc, and Kenya Airways.

Alaska + Hawaiian: Chester + Pualani

Over four years ago, a collaborative analysis was created with Brett Snyder of Cranky Flier. In that analysis, the case was made for a strategic merger between Alaska Airlines and Hawaiian Airlines.

Today – 1,501 days after the report was published – Alaska Airlines announced a merger with Hawaiian Airlines.

We present the original analysis published on October 24, 2019, and pose a question to Chester and Pualani:

What took so long?

Ever wonder what we do to make money? This is it.

You are reading our free newsletter, highlighting an interesting analysis from the prior week. A lot of work goes into this weekly analysis, but, it is merely a hint of the detailed data science and research we do every day for our customers.

Visual Approach Research is contrarian research to identify areas the market is overlooking. What do we mean by contrarian?

We don’t start from the assumption that what we hear in the market is true… or false. We start from the data, free from the assumptions.

Most of the time, our analysis agrees with the prevailing opinion. You never see those. For every analysis that makes it to Visual Approach Research, at least six were tossed.

But sometimes, the data paints a very different picture - contrary to the current narrative. That’s what we identify as contrarian.

Not opposite. New. Different.

For instance, in 2021, it wasn’t exactly popular to suggest a narrowbody shortage was inbound. Yet, contrary to the market narrative, the data led us to a very different conclusion. Our clients were aware of this a full year before it became mainstream.

Hundreds of leaders at aircraft lessors, investors, OEMs, and airlines receive our premium Visual Approach Research. If you would like to learn more, review our track record, and discuss how you can be a part of the contrarian conversation, simply reply to this email.

We very much appreciate our customers who continue to support our aviation habit.

You should do a chart on…

This week’s chart is a great example of a subscriber request.

“Hey,” offered said subscriber. “How about a look into the African market?”

So we did.

AI-generated chart that shows… nothing

We like to create valuable charts. But, it’s not easy coming up with new ideas amid the endless hours delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact