The A220 continues to add to its fleet size and global breadth. Focused primarily on Europe and North America, the aircraft will also soon be gracing the Australian skies with Qantas. This will leave South America as the lone remaining continent to commit to the aircraft.

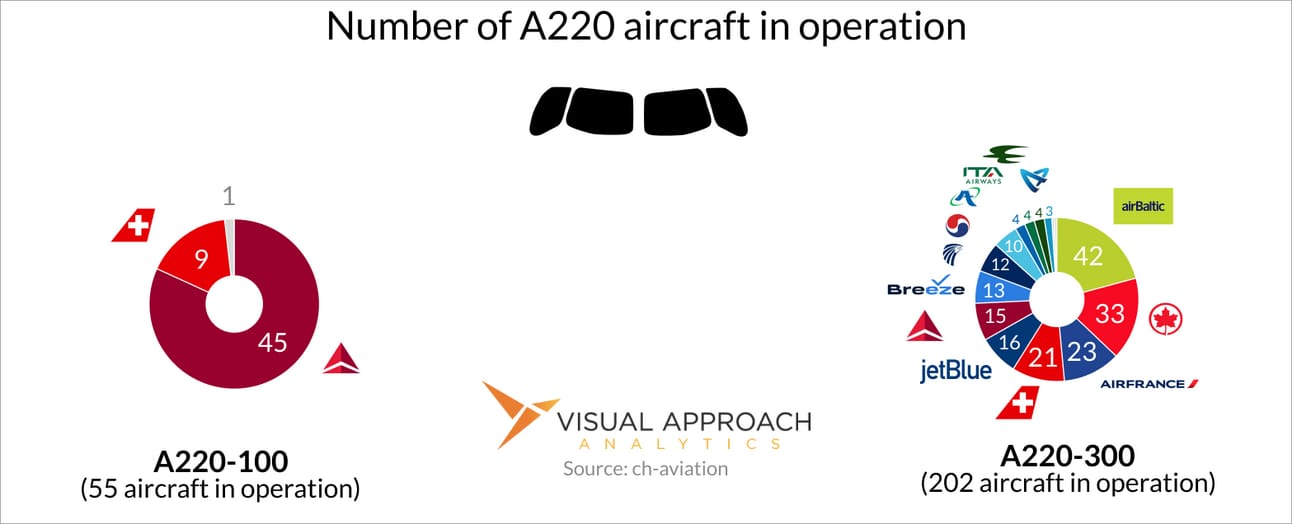

Considering June data from our go-to fleet source, ch-aviation, over 257 A220 aircraft are in operation with 14 operators. Six aircraft remain owned by lessors and are currently unassigned to leases; however, five of those aircraft are with GTLK - Russia's largest leasing company - and subsequently cannot be placed due to sanctions.

Notably absent from the list are Air Senegal and Air Manas, two scheduled carriers with parked A220s for separate reasons. Air Senegal is looking to sell its lone A220-300, while Air Manas remains subject to Russian sanctions due to the two aircraft being owned by GTLK.

Comlux Aviation Malta also operates a single A220-100ACJ.

From C to shining C

Swiss International Airlines and Delta Air Lines took early A220-100 aircraft and remain the only commercial operators of the type. Notably, both airlines also operate the A220-300 with order books that will add more of the larger -300 variant.

Notably, Delta Air Lines does not operate any A220 aircraft through their Atlanta hub, despite it being the largest operation in Delta's network. Rather, the aircraft is used across the North American continent in competitive secondary hubs such as Seattle and New York LaGuardia.

Air Canada and Breeze Airways both deploy their A220-300s on transcontinental routes. Air Baltic also shows off the A220's legs with long flights from its base in Riga. Air Baltic also offers wet-lease flying for SAS as supply chain shortages have left demand unfulfilled by lagging narrowbody deliveries.

AI is changing how we see the world - literally

We spend countless hours diving through artificial intelligence models, applying them to our forecasts and optimizing them for our clients' needs. While machine learning is the most common type of AI we use for our data science needs, we stay up-to-speed with the rest of the industry.

Of course, everyone has heard of ChatGPT for its natural language responses to our every question. Also making waves in the world of artificial intelligence is image creation with the likes of Dall-E, Stable Diffusion, Midjourney, and Adobe Firefly models, among others.

The results can be staggering:

We are not designers, but we do invariably find ourselves at the intersection of data science and design. Displaying data in a visually compelling way is what we do.

Which begs the question, how are the current AI models at portraying data?

The images above can be viewed as artistic representations of data. I specifically trained the model to consider various types of charts and infographics, playing with various styles and motifs. But the data is gibberish. It just looks pretty.

For instance, take a closer look at the blue infographic with the aircraft:

This infographic was created using a picture taken in real life to train the model (It started as a Breeze A220). The AI model did a fantastic job at capturing the feeling and sentiment of the picture and an infographic, only it missed that Breeze Airways happens two employ two main landing gear on each A220 - last we checked.

We have searched through every Type Certificate Data Sheet we know, even pulling out Jane's old reference, but cannot identify the aircraft waiting just outside the terminal window.

And my personal favorite. We call this composition not-so 767-ish?

The moral of the story is, artificial intelligence is wonderful at handling complex data, but it still isn't proficient at taking that complex data and turning it into a format easily understood by our simple brains.

So, I guess we'll have to just keep at it. We will be digging through countless datasets, adding to our databases, building and running our own models, and manually creating that interface between the data and our eyes.

Humans still required.

But that doesn't mean we aren't going to continue building our expertise of image models and exploring new training methods. Artificial intelligence continues to progress and impress.

Besides, it looks pretty.

Aircraft Intelligence Monthly

The June AIM is out covering new trends that are being overlooked in the industry. The insights you read in this newsletter are often born from the AIM, just months earlier. For instance, today's analysis was published in April.

The June AIM dives into seven trends that show the greatest disconnect between market perception and the data. Here is a high level of what we discuss in the June AIM:

Traffic recovery now limited by Pacific / available capacity

Narrowbodies have another decade of strong demand

Fleet shift in freighter market into next generation

in June, our subscribers also received our full chart library to use our charts in their own internal presentations.

If your organization wants to learn more about the AIM commercial subscription plans with our new chart library, you can learn more at this link.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.