A quick newsletter while the Americans are busy eating turkey.

News and rumours out of Spirit this week are not good. They raise the renewed question in the U.S. of whether the ULCC model is dead.

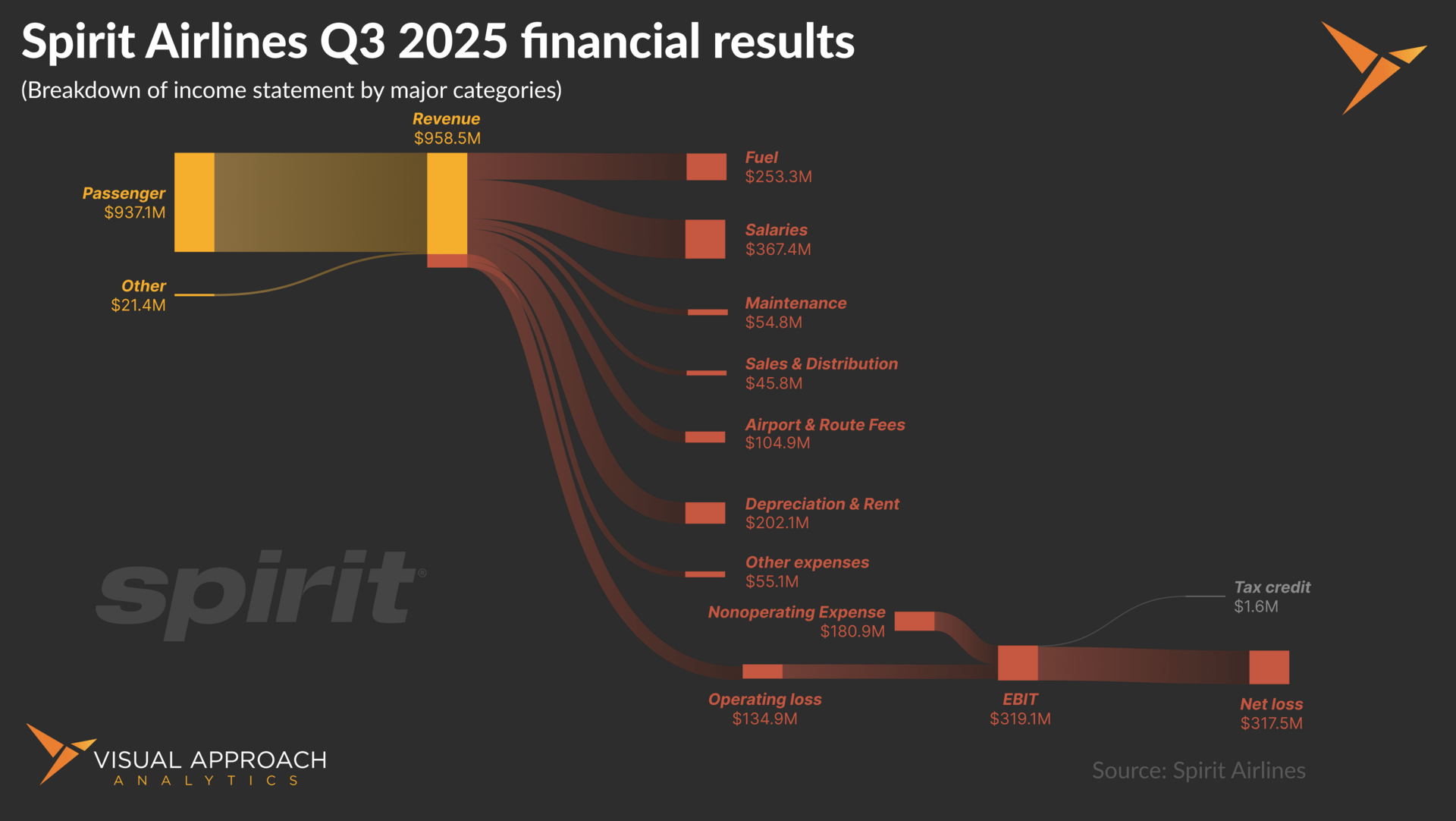

Of course, this is not a new question, just one that Spirit seems to return to the surface once a month or so. As it stands in Q3, Spirit’s operating costs exceeded its total revenues by a lot. Operating margins were -14.1%.

That’s not great, but we do have one to offer: Spirit’s Q3 took place before the restructuring (read: fleet halving) took place. We still see this as a reflection on the old Spirit, rather than the… uh… recent Spirit.

As the airline slides towards the abyss of airline history, the question we receive most is whether the ULCC model no longer works.

To answer that question, we offer a comparison chart of Ryanair. The Irish ULCC so kindly split out its Q3 financials for the same month ended Sep 30.

Notice the bright yellow bars and lines? The airline group ended the quarter with an operating margin of 35.5%.

35.5% - as in the most profitable airline in the world in Q3 2025 (or at least, the world’s Q3. Ryanair calls it their Q2. Maybe that’s their secret.)

If the ULCC model is dead, nobody told Ryanair.

Now, about that turkey...

Happy Thanksgiving!

Research published this week

You should do a chart on…

We like to create valuable charts. But it’s not easy to come up with new ideas amid the endless hours spent delivering data-driven edge to our customers. In our quest to provide a valuable weekly newsletter, we can keep guessing what you find most valuable, or you could just tell us.

If you have an idea for data visualization, reply to this email and let us know what analysis you’d find most valuable. We’d love to hear from you and will happily name-drop.

ACCESS OUR DATA AND ANALYSIS

We provide bespoke analysis to investors, lessors, and airlines looking for an edge in the market.

Our approach to analysis is data-driven and contrarian, seeking perspectives to lead the market, question consensus, and find emerging trends.

If a whole new approach to analysis could provide value to your organization, let's chat.

If you were forwarded this email, score!

As valuable as it is, don't worry; it's entirely free. If you would like to receive analyses like this regularly, subscribe below.

Then...

You can pay it forward by sending it to your colleagues. They gain valuable insights, and you get credit for finding new ideas!

Win-win!

Contact us

Have a question? Want to showcase your organization in a sponsored analysis? Reach out.

It’s easy. Just reply to this email.

Or, if you prefer the old way of clicking a link, we can help with the hard part: contact